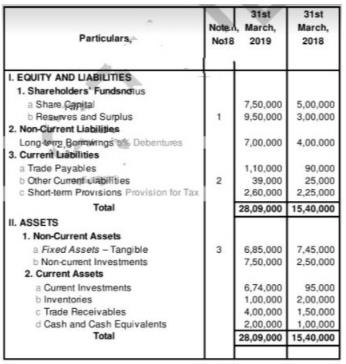

Investing cash flows are calculated by adding up the changes in long-term asset accounts. The investments are long-term in nature and expected to last more than one accounting period. You can think of this section as the company investing in itself. In other words, the investing section of the statement represents the cash that the company either collected from the sale of a long-term asset or the amount of money spent on purchasing a new long-term asset. Investing ActivitiesĬash flows from investing activities consist of cash inflows and outflows from sales and purchases of long-term assets. Operating cash flows are calculated by adjusting net income by the changes in current asset and liability accounts. For example, payment of supplies is an operating activity because it relates to the company operations and is expected to be used in the current period.

Operating activities are short-term and only affect the current period. In other words, the operating section represent the cash collected from the primary revenue generating activities of the business like sales and service income. The cash flow statement format is divided into three main sections: cash flows from operating activities, investing activities, and financing activities.Ĭash flows from operating activities include transactions from the operations of the business. In other words, a company with good cash flow can collect enough cash to pay for its operations and fund its debt service without making late payments. The term cash flow generally refers to a company’s ability to collect and maintain adequate amounts of cash to pay its upcoming bills. In other words, does the company have good cash flow? This is particularly important because investors want to know the company is financially sound while creditors want to know the company is liquid enough to pay its bills as they come due. This statement shows investors and creditors what transactions affected the cash accounts and how effectively and efficiently a company can use its cash to finance its operations and expansions. It also reconciles beginning and ending cash and cash equivalents account balances. The statement of cash flows, also called the cash flow statement, is the fourth general-purpose financial statement and summarizes how changes in balance sheet accounts affect the cash account during the accounting period.

0 kommentar(er)

0 kommentar(er)